Cordura Knee Patch Cargo Pants - Pads Not Included

(DN-3324)

| SKU | DN-3324 |

| Brand | DNC |

Click & Collect - $0.00

Be The First To Review This Product!

Help other HIP POCKET - TOOWOOMBA users shop smarter by writing reviews for products you have purchased.

(DN-3324)

| SKU | DN-3324 |

| Brand | DNC |

Help other HIP POCKET - TOOWOOMBA users shop smarter by writing reviews for products you have purchased.

1.1 Definitions

In these terms and conditions, unless the context otherwise requires:

(a) “Australian Consumer Law” means Schedule 2 of the Competition and Consumer Act 2010 (Cth) and the corresponding provisions of State Fair Trading legislation.

(b) “Buyer” means the Person or Organisation named in the relevant Sales Invoice, Instrument of Agreement or Quotation.

(c) “Business Day” means a day other than a weekend or public holiday in the place which the goods are delivered.

(d) “Consumer” means:

(e) “Excluded Loss” means:

(g) “Exclusive Goods” means any goods which are, at the Buyer’s request, embellished, embroidered, printed, machined, cut-to-size or specifically ordered for the Buyer.

(h) “GST” means the goods and services tax as imposed by the GST Law together with any related interest, penalties, fines, or other charge.

(i) “GST Amount” means any Payment (or the relevant part of that Payment) multiplied by the appropriate rate of GST.

(j) “GST Law” has the meaning given to that term in A New Tax System (Goods and Services) Act 1999, or, if that Act does not exist for any reason, means any Act imposing or relating to the imposition or administration of a goods and services tax in Australia and any regulation made under that Act.

(k) “Instrument of Agreement” means any instrument of agreement in which these terms and conditions are or are deemed to be incorporated.

(l) “Payment” means any amount payable under or in connection with a Quotation, Instrument of Agreement or Sales Invoice including any amount payable by way of indemnity, reimbursement or otherwise (other than a GST Amount) and includes the provision of any non-monetary consideration.

(m) “Person” includes an individual, the estate of an individual, a body politic, a corporation, an association (incorporated or unincorporated) and a statutory or other authority.

(n) “PPSA” means Personal Property Securities Act 2009 (Cth).

(o) “Purchase Price” means the price for the goods set out in the relevant Quotation, Instrument of Agreement or Sales Invoice.

(p) “Quotation” means the form of quotation (together with any supporting documentation, including range plans or other proposals) submitted by a Seller to the Buyer in which these terms and conditions are deemed to be incorporated.

(q) “Sales Invoice” means the sales invoice issued by a Seller to the Buyer in which these terms and conditions are or are deemed to be incorporated.

(r) “Tax Invoice” has the meaning given to that term by the GST Law.

(s) “Taxable Supply” has the meaning given to that term by the GST Law.

(t) “Seller” in relation to any Quotation, Instrument of Agreement or Sales Invoice means the relevant subsidiary (as that term is defined in the Corporations Act 2001 (Cth)) of Hip Pocket Workwear and Safety - Franchisee referred to in the Quotation, Instrument of Agreement or Sales Invoice to which the terms and conditions are incorporated.

1.2 Interpretation

(a) Any special conditions specified on a Quotation, Instrument of Agreement or Sales Invoice shall, to the extent they are inconsistent with these terms and conditions, take precedence over these terms and conditions.

(b) Words importing the singular shall include the plural (and vice versa).

(c) If any provision of these terms and conditions is invalid and does not go to the essence of these terms and conditions, these terms and conditions should be read as if that provision has been severed.

These are the only terms and conditions which are binding upon a Seller with the exception of those otherwise agreed in writing by the Seller which are imposed by a statute such as the Competition and Consumer Act 2010 (Cth) and which cannot be excluded. Any direction by the Buyer either verbal or written to procure goods or services from the Seller will be deemed as acceptance by the Buyer of these terms and conditions, despite any provisions to the contrary in the direction or any Purchase Order issued by the Buyer.

Payment to the Seller for goods delivered and accepted is due within 30 calendar days of the end of the month in which the Buyer is invoiced for the goods. If the Buyer fails to make payment in accordance with this clause, all amounts owing by the Buyer to the Seller named in the Sales Invoice, Instrument of Agreement or Purchase Order on any account shall immediately become due and payable. Each outstanding amount shall bear interest of the rate of 10% per annum calculated daily from the day it falls due until the day it is paid. The Buyer must pay the Seller (on a full indemnity basis) any costs (including legal costs) incurred by the Seller in taking steps to recover unpaid or overdue amounts under these terms and conditions.

The Buyer shall inspect all goods upon delivery and shall within two (2) Business Days of delivery give notice to the Seller named in the relevant Sales Invoice or of any matter or thing by which the Buyer alleges that the goods are not in accordance with the Buyer’s order. Failing such notice, subject to any non-excludable condition implied by law, such as those in the Competition and Consumer Act 2010 (Cth), the goods shall be deemed to have been delivered to and accepted by the Buyer.

Return of goods (other than in situations where the Seller is required to accept a return of goods under the Australian Consumer Law) must be approved by the Seller named in the relevant Sales Invoice or Instrument of Agreement. These authorised returns must be freight prepaid and will only be accepted if (unless otherwise agreed with the Seller) they are:

(a) in a saleable condition in their original packaging.

(b) accompanied by documentation evidencing:

Other than in situations where the Seller is required to accept a return of goods under the Australian Consumer Law:

(c) the Seller reserves the right to charge a handling fee of $10 or 10% of the price of the goods returned (whichever is greater) under this provision; and

(d) the Seller will not accept the return of goods specifically purchased, manufactured, machined or cut to size or to the Buyer’s specification.

(a) Unless previously withdrawn, a quotation is valid for 30 days or such other period as stated in it. A Quotation is not to be construed as an obligation to sell but merely an invitation to treat and no contractual relationship shall arise from it until the Buyer’s order has been accepted in writing by the Seller which provided the Quotation.

(b) No Seller shall be bound by any conditions attaching to the Buyer’s order or acceptance of a Quotation and, unless such conditions are expressly accepted by the relevant Seller in writing, the Buyer acknowledges that such conditions are expressly negatived.

(c) Every Quotation is subject to and conditional upon obtaining any necessary import, export or other licence.

(d) Where:

Seller is entitled to submit a revised schedule of prices in relation to the supply of such affected Goods. Such schedule of revised prices (Price Revision Notice) must set out the basis for any price variation as between the initial Quotation/Instrument of Agreement and the Price Revision Notice. Unless the Buyer provides written notice of its objection to such revised prices within 10 Business Days of receipt of the Price Revision Notice, the Buyer will be taken to have accepted the amendment to such prices on the terms set out in the Price Revision Notice. Where the Buyer provides written notice of its objection to such revised pricing specified in the Price Revision Notice, the Seller will be under no further obligation to supply any Goods referred to in the relevant Price Revision Notice.

7.0 GST

The parties agree that:

(a) the Purchase Price is inclusive of GST.

(b) all other Payments have been calculated without regard to GST.

(c) each party will comply with its obligations under the Competition and Consumer Act 2010 (Cth) when calculating the amount of any Payment and the amount of any relevant Payments will be adjusted accordingly.

(d) if the whole or any part of any Payment is the consideration for a Taxable Supply (other than for payment of the Purchase Price) for which the payee is liable to GST, the payer must pay to the payee an additional amount equal to the GST Amount, either concurrently with that Payment or as otherwise agreed in writing.

(e) any reference to a cost or expense in these terms and conditions excludes any amount in respect of GST forming part of the relevant cost or expense when incurred by the relevant party for which that party can claim an Input Tax Credit; and the payee will provide to the payer a Tax Invoice.

(a) Goods supplied by a Seller to the Buyer shall be at the Buyer’s risk immediately upon delivery to the Buyer, into the Buyer’s custody or at the Buyer’s direction (whichever happens first). The Buyer shall insure the goods from the time of that delivery at its cost against such risks as it thinks appropriate, shall note the interest of the Seller named in the relevant Sales Invoice or Instrument of Agreement on the insurance policy and shall produce a certificate of currency to this effect to that Seller upon request.

(b) Property in the goods supplied by a Seller to the Buyer under these terms and conditions shall not pass to the Buyer until those goods and other goods have been paid for in full.

(c) Until the goods have been paid for in full:

(d) The Buyer irrevocably authorises each Seller at any time to enter onto any premises upon which:

(e) The Buyer and each Seller agree that the provisions of this clause apply notwithstanding any arrangement under which that Seller grants credit to the Buyer.

(f) Each party consents to the other perfecting any security interest under these terms and conditions which arises by operation of the PPSA in any property by registration under the PPSA and agrees to do anything reasonably requested by the other party to enable it to do so.

(g) The parties contract out of each provision of the PPSA which, under section 115(1) of that Act, they are permitted to contract out of, other than:

(h) Each party waives its right to receive each notice which, under section 157(3) of the PPSA, it is permitted to waive.

(i) Each party waives its rights to receive anything from any other party under section 275 of the PPSA and agrees not to make any request of any other party under that section.

Each Seller reserves the right to immediately suspend, cancel or discontinue the supply of goods to the Buyer without further notice to the Buyer where:

(a) the Seller reasonably suspects that the Buyer is in breach of these terms and conditions; or

(b) the Buyer is otherwise in breach of its payment obligations to the Seller (whether arising under these terms and conditions or otherwise), and the Seller will not incur any liability to the Buyer in respect of such suspended, cancelled or discontinued supply.

From time to time, the Seller may decide (in its absolute discretion) to cease stocking particular goods (Discontinued Goods). Where the Seller knows that Discontinued Goods are currently the subject of an order, Instrument of Agreement or Quotation with the Buyer, the Seller will:

Each Seller reserves the right to make part deliveries of any order, and each part delivery shall constitute a separate sale of goods upon these terms and conditions. A part delivery of an order shall not invalidate the balance of an order.

A Seller’s Quotation or Sale Invoice is made on a supply only basis. Any training in the use of the goods or other fitting services (if any) are at the expense of the Buyer unless otherwise specified in writing by the relevant Seller.

(a) To the extent permitted by statute, any performance data provided by the Seller, a supplier or manufacturer is an estimate only and should be construed accordingly.

(b) Unless agreed to the contrary in writing, each Seller reserves the right to supply an alternative brand or substitute product that has characteristics that are materially consistent with the goods offered when necessary. Such substitutions will not be given effect to until approval is received from the Buyer (either verbally or in writing).

(c) Buyer must not, without Seller’s written consent, alter, remove, or obliterate any labels which are attached to or incorporated in the goods.

(a) Upon acceptance of an order by a Seller that Seller will seek confirmation of the period of shipment or delivery. If any variation has occurred in the quoted period, that Seller will notify the Buyer. Unless the Buyer objects in writing within 7 days of that notification to the Buyer, the period of shipment or delivery notified to the Buyer will be the contractual period for shipment or delivery.

(b) The Seller may impose a delivery charge on all deliveries (subject to such charge being notified to the Buyer in advance) with the exception of back order deliveries which are part of an original order that has been partly fulfilled.

The Seller reserves the right to:

(a) The Seller is entitled to conduct a review of all pricing set out in any unfilled Instrument of Agreement on or before the end of each 12-month period covered by that Instrument of Agreement.

(b) Whilst it is the intention of the Seller to hold pricing constant, the Seller reserves the right to revise pricing where:

(c) In all cases justification for price variations will be provided.

If the performance or observance of any obligations of any Seller is prevented, restricted or affected by reason of a force majeure event including strike, lock out, industrial dispute, raw material shortage, breakdown of plant, transport or equipment or any other cause beyond the reasonable control of the Seller, the Seller may, in its absolute discretion give prompt notice of that cause to the Buyer. On delivery of that notice the Seller is excused from such performance or observance to the extent of the relevant prevention, restriction or effect.

Unless otherwise agreed in writing, the Buyer shall have no right to cancel an order which has been accepted by a Seller. If a right of cancellation is expressly reserved to the Buyer, such right of cancellation must be exercised by notice in writing from the Buyer to the Seller with which the order has been placed not later than 7 days prior to the estimated date of shipment by the manufacturer or that Seller as the case may be. Unless otherwise agreed between the Buyer and Seller, upon cancellation prior to shipment any deposit paid by the Buyer shall be forfeited to the manufacturer or Seller (as the case may be). Despite the cancellation of any order for any reason, the Buyer must still purchase from the Seller any goods ordered by the Buyer which constitute Exclusive Goods (whether in store, in transit or being manufactured) which were procured or ordered by the Seller before such cancellation, unless otherwise agreed in writing by the Seller.

(a) Buyer shall immediately notify the Seller in writing of any defect in the goods supplied by the Seller. The Buyer shall not carry out any remedial work to allegedly defective goods without first obtaining the written consent of that Seller to do so. The provisions of this clause 18(a) do not constitute a warranty in relation to the quality or fitness of the goods, or require the Seller to repair or replace goods, or offer a refund in relation to goods, in circumstances other than those set out in Australian Consumer Law (to the extent that the Australian Consumer Law applies to the goods).

(b) The Competition and Consumer Act 2010 (Cth) and the Australian Consumer Law guarantee certain conditions, warranties and undertakings, and give you other legal rights, in relation to the quality and fitness for purpose of consumer goods sold in Australia. These guarantees cannot be modified nor excluded by any contract. Nothing in these terms and conditions purports to modify or exclude the conditions, warranties, guarantees and undertakings, and other legal rights, under the Australian Consumer Law and other laws which cannot be modified or excluded. Except as expressly set out in these terms and conditions and the Australian Consumer Law, the Seller makes no warranties or other representations under these terms and conditions. The Seller’s liability in respect of these warranties, representations, undertakings, and guarantees is limited to the fullest extent permitted by law.

(c) Without limiting clause 18(b), where the Seller sells goods to the Buyer, and the Buyer purchases them as a Consumer, then the Australian Consumer Law provides certain guarantees in relation to the goods. The rights of the Buyer buying goods as a Consumer include those set out in clause 18(e) below.

(d) Where goods are supplied to Consumers under these terms and conditions that supply is subject to guarantees that cannot be excluded under the Australian Consumer Law. In these circumstances, the Buyer is entitled to a replacement or refund for a major failure and for compensation for any other reasonably foreseeable loss or damage. The Buyer is also entitled to have the goods repaired or replaced if the goods fail to be of acceptable quality and the failure does not amount to a major failure.

(e) To the extent permitted by statute, the liability, if any, of the Seller arising from the breach of any implied conditions or warranties, or failure to comply with a statutory guarantee under the Australian Consumer Law, in relation to the supply of goods other than goods of a kind ordinarily acquired for personal, domestic or household use or consumption, shall at the Seller’s option be limited to:

(f) Subject to clause 18(b), the Seller shall not in any circumstances be liable to the Buyer under or in connection with these terms and conditions, or in negligence or any other tort or otherwise howsoever, as a result of any act or omission in the course of or in connection with the performance of these terms and conditions, for or in respect of any Excluded Loss.

(g) The Seller makes no express warranties in relation to the suitability for any purpose of goods or materials supplied by a Seller.

Where the Seller manufactures Exclusive Goods for the Buyer:

(a) The parties agree that the Seller may hold an inventory of stock in respect of Exclusive Goods, based on the Seller’s good faith forecast of the Buyer’s future Exclusive Good purchasing levels.

(b) If:

the Buyer must purchase all Exclusive Goods (together with any fabric inventory or works in progress held exclusively or predominantly for the purpose of manufacturing Exclusive Goods) from the Seller upon demand.

(c) If Exclusive Goods are required to be purchased by the Buyer as a result of this clause 20, the Supplier must prepare and submit to the Buyer a Sales Invoice detailing the current holding of Exclusive Goods to be purchased by the Buyer.

(d) The price payable by the Buyer for the Exclusive Goods (other than fabric inventory or works in progress) under the Sales Invoice must be no more than the maximum price per Good previously charged to the Buyer under the relevant Instrument of Agreement the Instrument of Agreement or any previous Quotation or Sales Invoice. The price payable in respect of all fabric inventory or works in progress comprising Exclusive Goods will be cost to the Seller plus 10%.

(e) Payment for Exclusive Goods will be in accordance with clause 3 of these terms and conditions.

Nothing in these terms and conditions creates any right, title or interest in any intellectual property right (including trademark, copyright, patent or registered design) (Intellectual Property) in favour of the Buyer with respect to any good supplied under these terms and conditions.

Unless the parties otherwise agree in writing, the ownership of all Intellectual Property supplied or created by the Seller in connection with or because of the performance of these terms and conditions will vest in the Seller.

The Buyer indemnifies the Seller from and against all losses, claims, liabilities, demands and expenses (Claims) arising from or relating to the use or infringement any third party’s Intellectual Property to the extent that such Claim relates to or is in connection with any Intellectual Property provided to the Seller by the Buyer in connection with these terms and conditions.

A Seller may, at any time and from time to time, alter these terms and conditions, provided that any variation to these standard terms and conditions will not apply to any:

(a) orders placed but not yet fulfilled prior to the date of such variation taking effect; or

(b) contract for a specified term that incorporates a version of these standard terms and conditions released prior to the variations.

To the fullest extent permitted by law, the United Nations Convention on Contracts for the International Sale of Goods (Vienna 1980) known as the Vienna Sales Convention does not apply to the contract comprised by these terms and conditions nor do any of the terms and conditions express or implied by the Vienna Sales Convention form part of the contract.

These terms and conditions and any contract including them shall be governed by and construed in accordance with the laws of the State of Victoria and the Seller and the Buyer submit to the non-exclusive jurisdiction of the Courts of Victoria.

Hip Pocket Workwear & Safety collects the following personal information when you place an order with us:

In accordance with PCI-DSS standards, credit card numbers are not stored in our systems. When purchasing from Hip Pocket Workwear & Safety your financial details are passed through to a secure server using root encryption technology.

Use of Personal InformationThe information you provide is used to process and fulfil your order and to keep you informed about the status of your order.

Site visitors and customers are required to “OPT IN” to subscribe to our electronic direct marketing (EDM) database. This information is only used by Hip Pocket Workwear & Safety to send marketing or promotional materials from time to time. You can unsubscribe at any time by using the Unsubscribe function within the electronic marketing material.

A cookie is a small text file that is stored on your computer's hard drive by your web browser which tracks your movements and preferences within websites. Hip Pocket Workwear & Safety uses cookies for tracking purposes and the data our server collects may include:

This information is collected for private analysis and evaluation of our website to help improve site functionality, services and products. This data will not be used in association with any other personal information. Hip Pocket Workwear & Safety will not disclose any information collected by our use of cookies about any individual without the individual's consent, except to comply with applicable law or valid legal process.

Most browsers are set to accept cookies by default but can be altered to prevent automatic acceptance – see Settings on your browser. If you choose not to receive cookies, you will still be able to browse the site and make purchases if desired, but some site functionality will be lost.

This Privacy Policy does not apply to websites maintained by other companies or organisations to which we link, nor are we responsible for any information you submit to third parties via our website. We encourage you to read the Privacy Policy of such companies prior to submitting your details.

Whilst connected to the Internet you must always be vigilant when it comes to supplying people with your personal details. At Hip Pocket Workwear & Safety we use encryption on our web servers when you transfer any details to us that might be sensitive. This means that if someone else was watching the information as it is being sent, they cannot read it due to the encryption.

Hip Pocket Workwear & Safety will not disclose any information about any individual without the individual's consent, except to comply with applicable laws or legislated requirements.

Hip Pocket Workwear & Safety does not sell or otherwise share information collected with third parties for marketing and/or other purposes. Any communications you subscribe to will originate only from Hip Pocket Workwear & Safety.

Hip Pocket Workwear & Safety reserves the right to modify or change our Privacy Policy at any time without notice while maintaining our compliance with the Privacy Act 1988. We recommend you check back regularly to read any changes.

You may make enquiries or register complaints concerning our Privacy Policy, or the way in which we collect and handle your personal information, via the Contact Us information on our Website Home Page. We will respond to your concerns as soon as practicably possible.

|

|

67R |

72R |

77R |

82R |

87R |

92R |

97R |

102R |

107R |

112R |

117R |

122R |

127R |

132R |

|

To fit waist (cm) |

67 |

72 |

77 |

82 |

87 |

92 |

97 |

102 |

107 |

112 |

117 |

122 |

127 |

132 |

|

To fit waist (inches) |

26 |

28 |

30 |

32 |

34 |

36 |

38 |

40 |

42 |

44 |

46 |

48 |

50 |

52 |

|

In-leg garment measurements |

70 |

73 |

76 |

79 |

81 |

84 |

85 |

86 |

87 |

88 |

88 |

88 |

88 |

89 |

|

To fit chest (cm – for overalls) |

77 |

82 |

87 |

92 |

97 |

102 |

107 |

112 |

117 |

122 |

127 |

132 |

137 |

142 |

|

|

87S |

92S |

97S |

102S |

107S |

112S |

117S |

122S |

127S |

132S |

137S | 142S | 147S | 152S |

|

To fit waist (cm) |

87 |

92 |

97 |

102 |

107 |

112 |

117 |

122 |

127 |

132 |

137 | 142 | 147 | 152 |

|

To fit waist (inches) |

34 |

36 |

38 |

40 |

42 |

44 |

46 |

48 |

50 |

52 |

54 | 56 | 58 | 60 |

|

In-leg garment measurements (cm) |

72 |

74 |

76 |

78 |

80 |

80 |

80 |

80 |

80 |

80 |

80 | 80 | 80 | 80 |

|

To fit chest (cm – for overalls) |

97 |

102 |

107 |

112 |

117 |

122 |

127 |

132 |

137 |

142 |

147 | 152 | 157 | 162 |

|

|

74L |

79L |

84L |

89L |

94L |

99L |

104L |

|

To fit waist (cm) |

74 |

79 |

84 |

89 |

94 |

99 |

104 |

|

To fit waist (inches) |

29 |

31 |

33 |

35 |

37 |

39 |

41 |

|

In-leg garment measurements (cm) |

82 |

82 |

85 |

87 |

89 |

89 |

89 |

|

To fit chest (cm – for overalls) |

87 |

92 |

97 |

102 |

107 |

112 |

117 |

|

|

72R |

77R |

82R |

87R |

92R |

97R |

102R |

107R |

|

To fit waist (cm) |

72 |

77 |

82 |

87 |

92 |

97 |

102 |

107 |

|

To fit waist (inches) |

28 |

30 |

32 |

34 |

36 |

38 |

40 |

42 |

|

In-leg garment measurements (cm) |

78 |

80 |

82 |

84 |

86 |

88 |

90 |

92 |

|

In-leg garment measurements (inches) |

31 |

31.5 |

32 |

33 |

34 |

34.5 |

35.5 |

36.5 |

|

|

87S |

92S |

97S |

102S |

107S |

112S |

117S |

122S |

127S |

132S |

137S | 142S | 147S | 152S |

|

To fit waist (cm) |

87 |

92 |

97 |

102 |

107 |

112 |

117 |

122 |

127 |

132 |

137 | 142 | 147 | 152 |

|

To fit waist (inches) |

34 |

36 |

38 |

40 |

42 |

44 |

46 |

48 |

50 |

52 |

54 | 56 | 58 | 60 |

|

In-leg garment measurements (cm) |

72 |

74 |

76 |

78 |

80 |

80 |

80 |

80 |

80 |

80 |

80 | 80 | 80 | 80 |

|

In-leg garment measurements (inches) |

28 |

29 |

29 |

30 |

30 |

30 |

30 |

30 |

30 |

30 |

30 | 30 | 30 | 30 |

|

|

74L |

79L |

84L |

89L |

94L |

|

To fit waist (cm) |

74 |

79 |

84 |

89 |

94 |

|

To fit waist (inches) |

29 |

31 |

33 |

35 |

37 |

|

In-leg garment measurements (cm) |

84 |

86 |

88 |

90 |

92 |

|

In-leg garment measurements (inches) |

33 |

34 |

34.5 |

35.5 |

36.5 |

|

Sizes |

2XS |

XS |

S |

M |

L |

XL |

2XL |

3XL |

4XL |

5XL |

6/7XL |

8/9XL |

10/11XL |

|

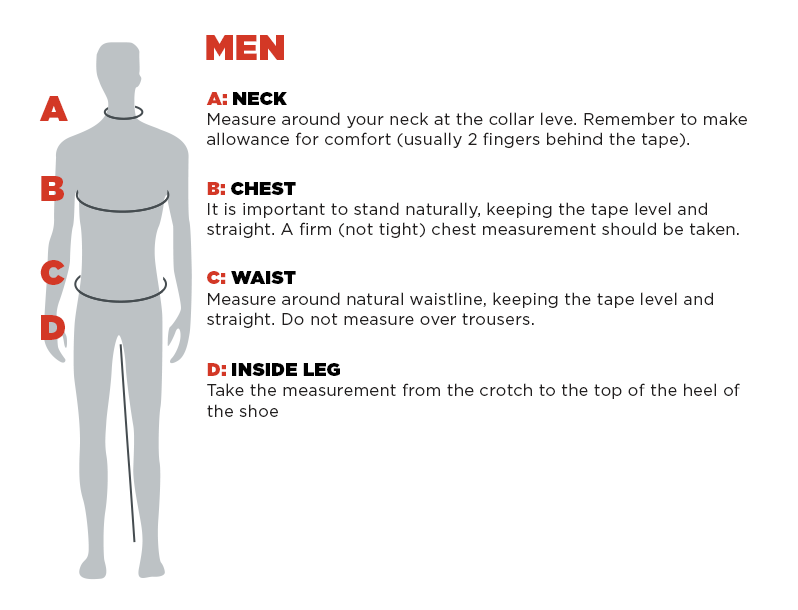

To fit neck (cm) |

32/33 |

34/35 |

36/37 |

38/39 |

41/42 |

43/44 |

45/46 |

47/48 |

49/50 |

51/52 |

53/56 |

57/60 |

61/64 |

|

To fit neck (inches) |

13 |

14 |

14.5 |

15 |

16.5 |

17 |

18 |

19 |

19.5 |

20 |

21/22 |

22/23.5 |

24/25 |

|

To fit chest (cm) |

82 |

87 |

92 |

97 |

102 |

107 |

112 |

117 |

122 |

127 |

132/137 |

142/147 |

152/157 |

|

To fit chest (inches) |

32 |

34 |

36 |

38 |

40 |

42 |

44 |

46 |

48 |

50 |

52-54 |

56-58 |

60-62 |

|

Sizes |

2XS |

XS |

S |

M |

L |

XL |

2XL |

3XL |

4XL |

5XL |

6/7XL |

8/9XL |

10/11XL |

|

|

10 |

14 |

16 |

18 |

20 |

22 |

24 |

26 |

28 |

30 |

32/34 |

36/38 |

40/42 |

|

To fit chest (cm) |

82 |

87 |

92 |

97 |

102 |

107 |

112 |

117 |

122 |

127 |

132/137 |

142/147 |

152/157 |

|

To fit chest (inches) |

32 |

34 |

36 |

38 |

40 |

42 |

44 |

46 |

48 |

50 |

52/54 |

56/58 |

60/62 |

|

Sizes |

2XS |

XS |

S |

M |

L |

XL |

2XL |

3XL |

4XL |

5XL |

6/7XL |

8/9XL |

10/11XL |

|

|

10 |

14 |

16 |

18 |

20 |

22 |

24 |

26 |

28 |

30 |

32/34 |

36/38 |

40/42 |

|

To fit chest (cm) |

82 |

87 |

92 |

97 |

102 |

107 |

112 |

117 |

122 |

127 |

132/137 |

142/147 |

152/157 |

|

To fit chest (inches) |

32 |

34 |

36 |

38 |

40 |

42 |

44 |

46 |

48 |

50 |

52/54 |

56/58 |

60/62 |

|

Sizes |

6 |

8 |

10 |

12 |

14 |

16 |

18 |

20 |

22 |

24 |

26 |

28 | 30 | 32 | 34 |

|

|

2XS |

XS |

S |

M |

L |

XL |

2XL |

3XL |

4XL |

5XL |

6XL |

7XL | 8XL | 9XL | 10XL |

|

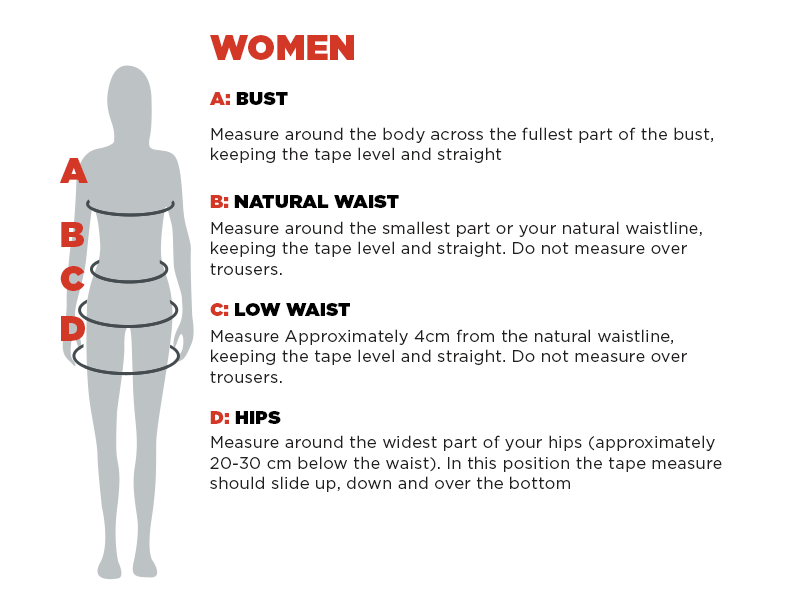

To fit bust (cm) |

81 |

86 |

91 |

96 |

101 |

106 |

111 |

116 |

121 |

126 |

131 |

136 | 141 | 146 | 151 |

|

To fit waist (cm) |

64 |

69 |

74 |

79 |

84 |

89 |

94 |

99 |

104 |

109 |

114 |

119 | 124 | 129 | 134 |

|

To fit hips (cm) |

89 |

94 |

99 |

104 |

109 |

114 |

119 |

124 |

129 |

134 |

139 |

144 | 149 | 154 | 159 |

|

In-leg garment measurements (cm) |

79 |

80 |

80 |

81 |

81 |

82 |

82 |

85 |

85 |

86 |

86 |

87 | 87 | 88 | 88 |

|

UK/AUS |

4 |

5 |

6 |

7 |

8 |

8.5 |

9 |

9.5 |

10 |

10.5 |

11 |

12 |

13 |

14 | 15 | 16 |

|

EURO |

38 |

39 |

40 |

41 |

42 |

42.5 |

43 |

43.5 |

44 |

45 |

46 |

47 |

48 |

49 | 50 | 51 |

|

USA |

5 |

6 |

7 |

8 |

9 |

9.5 |

10 |

10.5 |

11 |

11.5 |

12 |

13 |

14 |

15 | 16 | 17 |

|

US/AUS |

4 |

5 |

5.5 |

6 |

6.5 |

7 |

7.5 |

8 |

8.5 |

9 |

9.5 |

10 |

|

EURO |

35 |

36 |

36.5 |

37 |

37.5 |

38 |

38.5 |

39 |

39.5 |

40 |

40.5 |

41 |

|

UK |

2 |

3 |

3.5 |

4 |

4.5 |

5 |

5.5 |

6 |

6.5 |

7 |

7.5 |

8 |

The measurements shown are the wearer’s size and intended as a guide only.

Hip Pocket Workwear & Safety website employs cookies to improve your user experience, for social media features and to analyse our traffic. By continuing to browse or by clicking ‘Accept’ you agree to the cookies on this website. For more information, please read our Privacy Policy.Accept

Add your favourites to cart

Select Afterpay at checkout

Log into or create your Afterpay account, with instant approval decision

Your purchase will be split into 4 payments, payable every 2 weeks

All you need to apply is to have a debit or credit card, to be over 18 years of age, and to be a resident of country offering Afterpay

Late fees and additional eligibility criteria apply. The first payment may be due at the time of purchase

For complete terms visit afterpay.com/terms